how to claim working from home allowance

This could be a diary or a timesheet. Option 1 of 2 Complete Form T777S - Statement of Employment Expenses for Working at Home Due to COVID-19 if you are.

Working From Home You Can Claim Coronavirus Tax Relief Suits Me Blog

Once their application has been approved the online portal will adjust their tax code for the 2021.

. The arrangements in this section only apply to remote working. You need to keep a record of how many hours you work from home. Claiming working from home expenses.

Your employee is required to perform essential duties of the employment at home. You can only claim for the days you worked from home as a remote worker. For more information please see the page How to calculate allowable remote working costs.

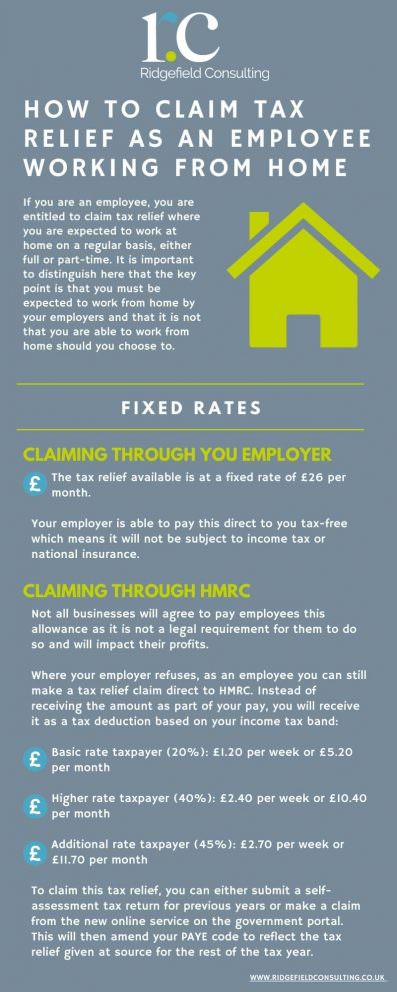

Posted Tue 11 Jan 2022 225711 GMT by londonerinheart. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. Employees can claim allowance for working from home.

To be able to use this method. Read the employment tax consequences of working from home. To claim for the working from home tax relief.

How to apply. This is to cover all your extra costs of working from home. If two or more of you live in the same property youre all required to work from home and its fair to say that costs have increased specifically from each individual working from home you can all claim it.

Things you bought like a desk your higher bills like electricity or phone. To claim for tax relief for working from home employees can apply directly via GOVUK for free. They do not apply when you bring work home outside of normal working hours.

Form for those working from home due to the COVID-19 pandemic who are only claiming home office expenses. You must have spent the money. The position with regard to partners is quite different and firms need to somehow keep a record of the hours.

In some instances your employer may provide a special allowance to cover the costs of this. You need your Government Gateway ID if you dont have one you can create one during the process State the date you started working from home. The HMRC online portal is incredibly simple to use and you can make your claim in a few minutes.

Due to COVID-19 many employees are now working from home. The working-from-home tax relief is an individual benefit. If the above criteria have been met then you may deduct.

The expense must directly relate to earning your income. Youll need to have your Government Gateway ID to hand if you dont have one yet you can set it up during this process. Claim for your home office if you started working from home at the end of March and worked there for at least 6 months till the.

Claiming working from home expenses. I remember last year I could easily find. So if youve had an increase in costs because youre required to work from home you can claim it.

If you are claiming Remote. The allowance is to cover tax-deductible additional costs that. You can claim 080 for every hour you worked from home.

A new temporary flat rate method will allow eligible employees to claim a deduction of 2 for each day they worked at home in that period plus any other days they worked from home in 2020 due to COVID-19 up to a maximum of 400. HMRC clarified their guidance with regard to employees for the tax years 202021 and 202122 and allowed relief to be claimed regardless of the actual number of hours worked from home. You dont need any supporting documents for this method nor do you need a signed T2200.

1208 28 Jan 2022. COVID-19 Employment allowances and reimbursements However in many cases you will be expected to bear these. Calculating your working from home expenses.

I have been working from home since 5 March and cannot find how to claim the allowance on my tax return. A relaxed tax-break that paid employees 125 for working from home during the pandemic will come to an end this year it has emerged. You can make the payment of 320 per workday tax free when.

You cannot claim for anything else. Rishi Sunak is expected to close HMRCs. Select Remote Working Expenses and insert the amount of expense at.

You can claim a tax deduction if you worked from home for more than half of your total working hours or for more than six months during the tax year that started in March 2020. As an employee to claim a deduction for working from home all the following must apply. It will then open a section later on where you can claim the allowance.

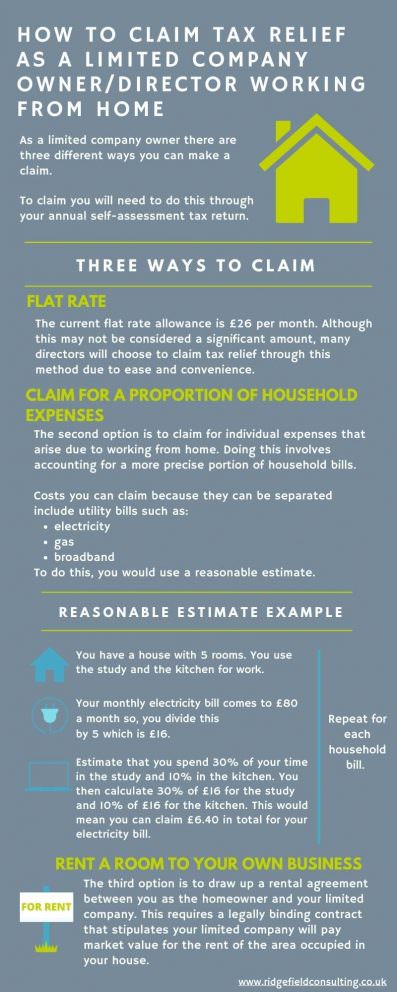

More than 50 of your work needs to be performed in the home office in other words you must work from home for at least six months of the tax year. Rental or bond interest on your home and home repairs Municipal rates electricity and water. If you do then simply make a claim on your 202021 tax return.

In the Tax Credits and Reliefs page Page 4 of 5 select the Your job tab. There is a formal agreement between you and your employee that the employee is required to work from home. The way you claim the working from home allowance will depend upon if you submit a self-assessment tax return.

Everyone else needs to make a claim to HMRC by post telephone or via the new P87 micro-service HMRC launched on 1 October 2020. Your employee is required to work for substantial periods at home. Head over to the new HMRC tax relief microservice page and follow the instructions there.

A link to the online portal can be found here. Hiya I am also trying to find the relevant sectionquestion to claim for working from home tax relief and my online application doesnt have such a section. Those who do not submit a self-assessment tax return should simply make a claim to HMRC by post telephone or via the new P87 micro-service HMRC launched on October 1 2020.

Under this new method employees will not have to get Form T2200 or Form T2200S completed and signed by their. How do I claim tax relief for working from home. Your employer will need to determine if this allowance is taxable or not.

Select the Income Tax return for the relevant tax year. Claim 2 for each day that you worked at home during that period plus any other days you worked at home in 2020 due to COVID-19 up to a maximum of 400. Employees required to work from home can have a 6 per week or 26 per month allowance paid tax-free by employers or during the pandemic can claim a deduction from earnings for this allowance HMRC has confirmed.

As I complete a self assessment for property I own it states it must be done through this however cannot see anywhere or the form to add this. Claim the amount on line 22900 of your tax return. You must have a record to prove it.

Click on Review your tax link in PAYE Services. Good news if youve been working from home for the past year.

Different Ways To Claim Tax Relief When Working From Home

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

Money Savvy Teacher Tax Relief For Teachers Working From Home

Work From Home Tax Relief Scheme How It Works For 2021 22 This Is Money

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

Martin Lewis Working From Home Due To Coronavirus Even For A Day Claim Two Years Worth Of Tax Relief

0 Response to "how to claim working from home allowance"

Post a Comment